Mortgage pre-approval is pertinent if you are looking for your first or your dream home. If you’re looking for a home, particularly your first one, you should meet with a mortgage lender from the start. Having a mortgage pre-approval letter from a lender will save time for you, your agent, and the seller. What do you need to provide the lender to get a pre-approval? Here’s a guide.

What is mortgage pre-approval?

Sellers and agents like knowing that a home shopper can put their money where their mouth is. Getting a mortgage pre-approval letter shows that you are a serious buyer with the financial means to actually purchase.

People often confuse pre-qualification with pre-approval. Both involve talking to a mortgage lender, but with pre-qualification, the lender’s review of your financial status is more cursory. If you’re after a mortgage pre-approval letter, the lender will undertake a much more detailed analysis. That means you’ll have to provide a significant amount of documentation of your financial status.

What to provide to the lender

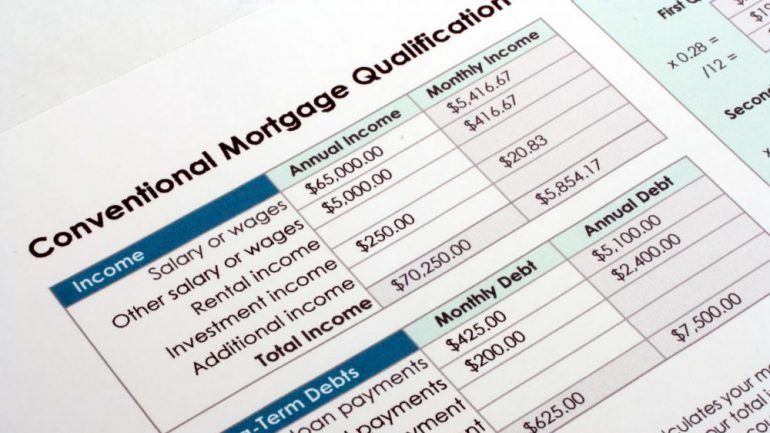

- The lender will want to know your income to calculate your debt-to-income ratio, otherwise known as the front-end ratio. To determine yours, the mortgage company will divide a potential house payment by your monthly income. This ratio should be no higher than 28 percent. To show your income, they will ask you to provide W-2 forms for the last two years, a pay statement for the most recent month, and two years of tax returns. The lender requires additional documents if you are self-employed, including an Internal Revenue Service form known as Schedule K. If you’ll need income from you and your spouse to qualify for a mortgage, you should provide documentation for both of you.

- Provide documentation of your employment to show the lender that you are financially stable and have the means to pay back your mortgage loan. The lender will ask for a list of your current payment obligations. The lender will combine these payments with a potential house payment and compare them to your income. This number is known as the back-end ratio and should not exceed 36 percent of your income.

- For mortgage pre-approval, you’ll need to supply bank and investment statements for at least three months. The lender wants this proof of financial assets to determine whether you have ample down payment money and liquidity for the purchase and beyond.

- The lender will want written permission to pull your credit report. This is because your payment history plays a huge role in whether you’ll be approved for a loan and what sort of loan terms the lender will offer you. You can check your credit report yourself to know where you stand. Everyone is entitled to one free credit history report per year.

- Finally, you will provide various other documents, such as your driver’s license and Social Security card.

After the approval

Once pre-approved, you will receive an official letter from the lender that you can show your agent and sellers. It is usually good for six months, which gives you time to shop. During this time period, don’t change your credit profile by taking out new debt or making late payments.

Keep in mind that pre-approval is not final approval. When you put a contract on a house, the lender will require further documentation. They will also undertake further analysis before approving you for the specific loan you need.

You are not obligated to borrow from the lender who provided the mortgage pre-approval letter if you find better terms elsewhere.